Supra Crypto Tax Calculator

Supracalc will be closing down before 30th october 2025 - we may enable the service when there is more demand

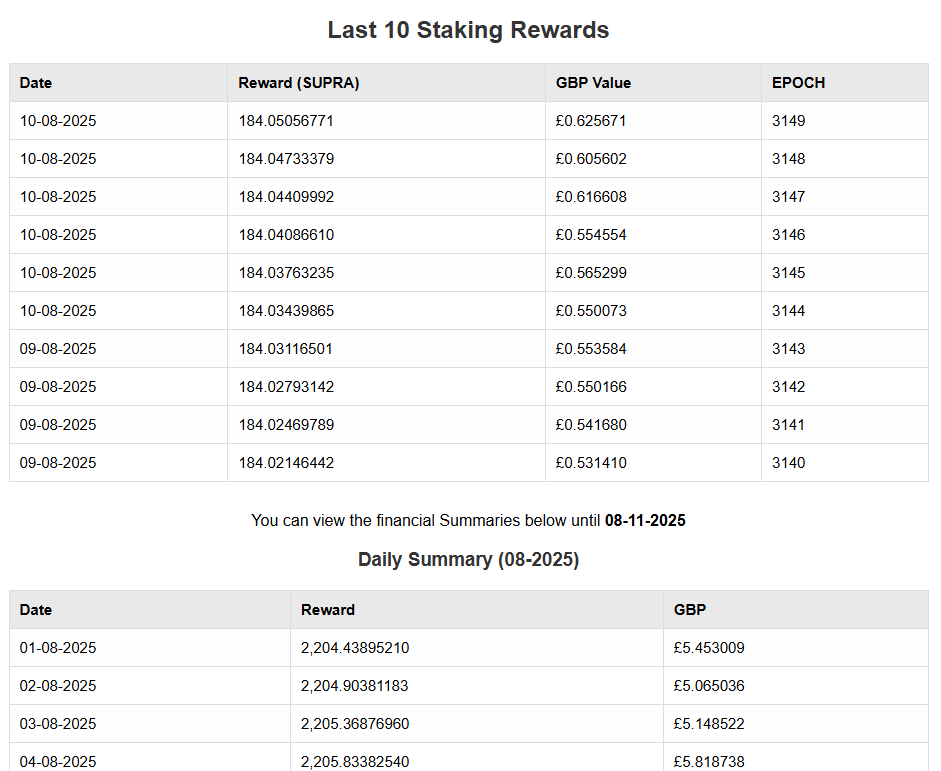

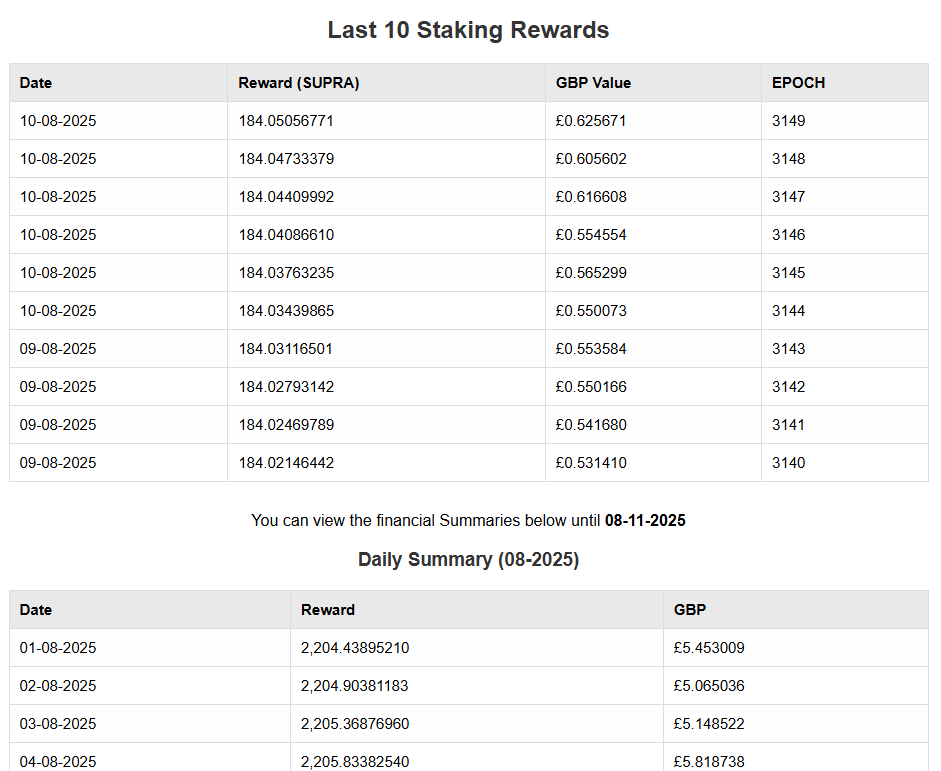

SUPRA Tax Calculator

SUPRA Tax Calculator

Supracalc will be closing down before 30th october 2025 - we may enable the service when there is more demand